Global Health Limited

Please refer to important disclosures at the end of this report

1

Incorporated in 2004, Global Health Limited (GHL) is one of the largest private

multi-speciality tertiary care providers operating in the North and East regions

of India. The company has key specialties in cardiology and cardiac science,

neurosciences, oncology, digestive and hepatobiliary sciences, orthopedics,

liver transplant, and kidney and urology. GHL has a network of 5 hospitals

currently in operation (Gurugram, Indore, Ranchi, Lucknow, and Patna) under

the "Medanta" brand. GHL provides healthcare services in over 30 medical

specialties and engages over 1,300 doctors led by experienced department

heads and, spanning over an area of 4.7 million sq. ft., its operational hospitals

have 2,467 installed beds.

Positives: (a) Strong track record of operational and financial performance (b)

Growth opportunities in existing facilities and diversification into new services,

including digital health (c) Leading tertiary and quaternary care provider in India,

well recognized for clinical expertise in dealing with complicated cases

Investment concerns: (a) High dependence on third party suppliers for raw

materials and on sub-contractors for cleaning and maintenance work (b) High

competitive intensity (c) Worsening of economic conditions would lead to slowdown

in business

Outlook & Valuation: In terms of valuations, the post-issue P/E works out to 45.9x

FY22 EPS (at the upper end of the issue price band) which is in line with its peers like

Narayana Hrudayalaya, Max Healthcare Institute Ltd and Apollo Hospitals Enterprise

Ltd. Further, GHL has better revenue/PAT growth (CAGR of 20%/132% respectively)

over 2 years, weaker return on equity and company also faces near term headwinds.

Considering all the factors, we believe this valuation is at reasonable levels. Thus, we

recommend a NEUTRAL rating on the issue.

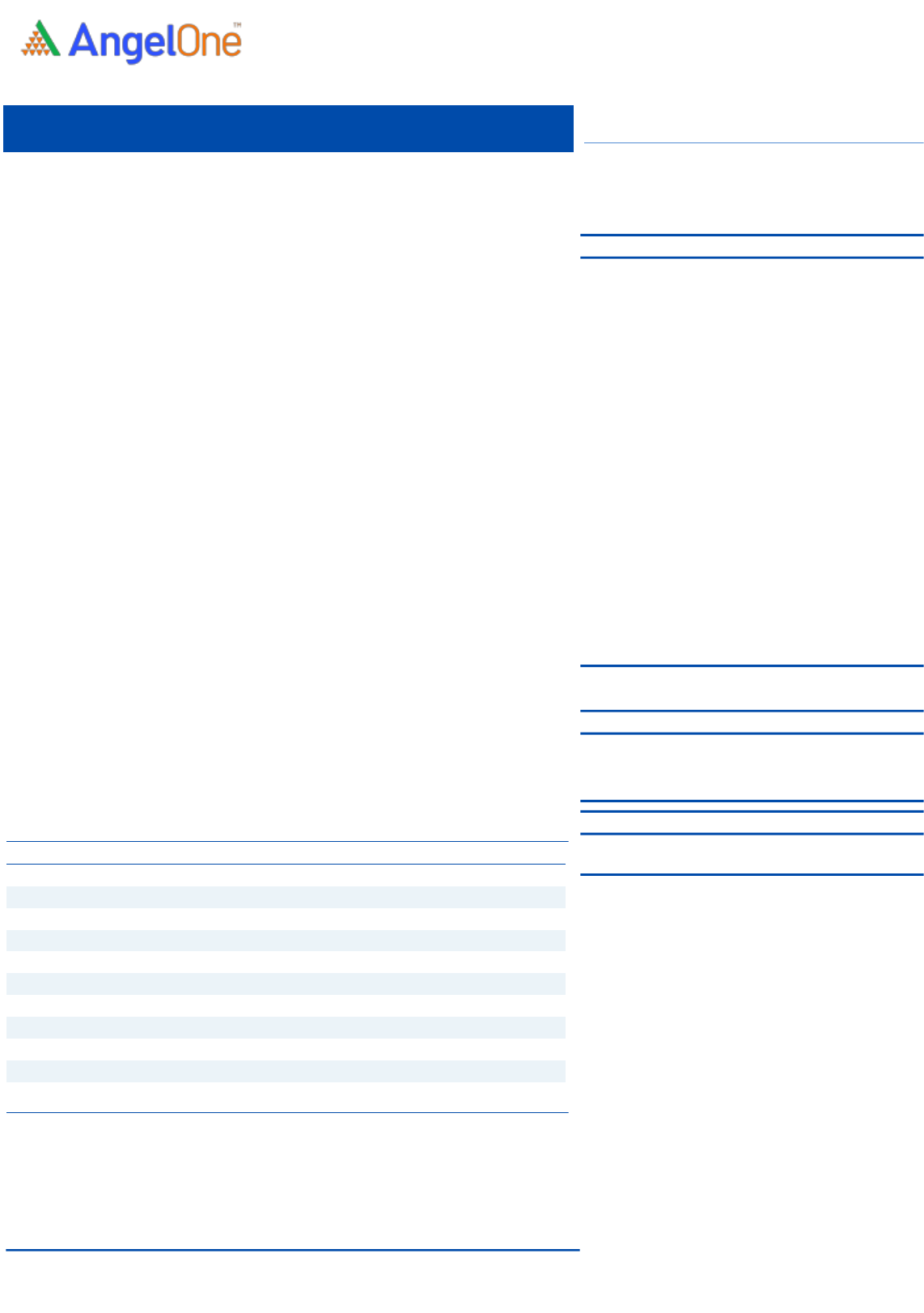

Key Financials

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Net Sales

1,500

1,447

2,167

% chg

-4%

50%

Net Profit

36

29

196

% chg

-21%

581%

EBITDA (%)

4.8

4.7

14.8

EPS (Rs)

1.4

1.1

7.7

P/E (x)

248.4

313.2

46.0

P/BV (x)

6.7

6.5

5.6

ROE (%)

2.7

2.1

12.1

ROCE (%)

3.1

2.9

11.8

EV/Sales

6.5

6.7

4.4

Source: Company RHP, Angel Research

NEUTRAL

Issue Open: November 03, 2022

Issue Close: November 07, 2022

Offer for Sale: ` 1,706cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 33.1%

Public 66.9%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 53.62cr

Issue size (amount): ₹ 2,206cr

Price Band: ₹319 - ₹336

Lot Size: 44 shares and in multiple thereafter

Post-issue mkt. cap: * `8,580cr - ** `9,011cr

Promoters holding Pre-Issue: 35.03%

Promoters holding Post-Issue: 33.08%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: ` 500cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: ` 50.65cr

IPO NOTE

Global Health Limited

November 2, 2022

Global Health Ltd | IPO Note

November 2, 2022

2

Company background

Incorporated in 2004, Global Health Limited (GHL) is one of the largest private

multi-speciality tertiary care providers operating in the North and East regions of

India. The company has key specialties in cardiology and cardiac science,

neurosciences, oncology, digestive and hepatobiliary sciences, orthopedics, liver

transplant, and kidney and urology. GHL has a network of 5 hospitals currently in

operation (Gurugram, Indore, Ranchi, Lucknow, and Patna) under the "Medanta"

brand. GHL provides healthcare services in over 30 medical specialties and engages

over 1,300 doctors led by experienced department heads and, spanning over an

area of 4.7 million sq. ft., its operational hospitals have 2,467 installed beds.

Issue details

The IPO is made up of Fresh issue of ₹500cr and offer for sale of ₹1,706cr

making the total Issue size of ₹2,206cr.

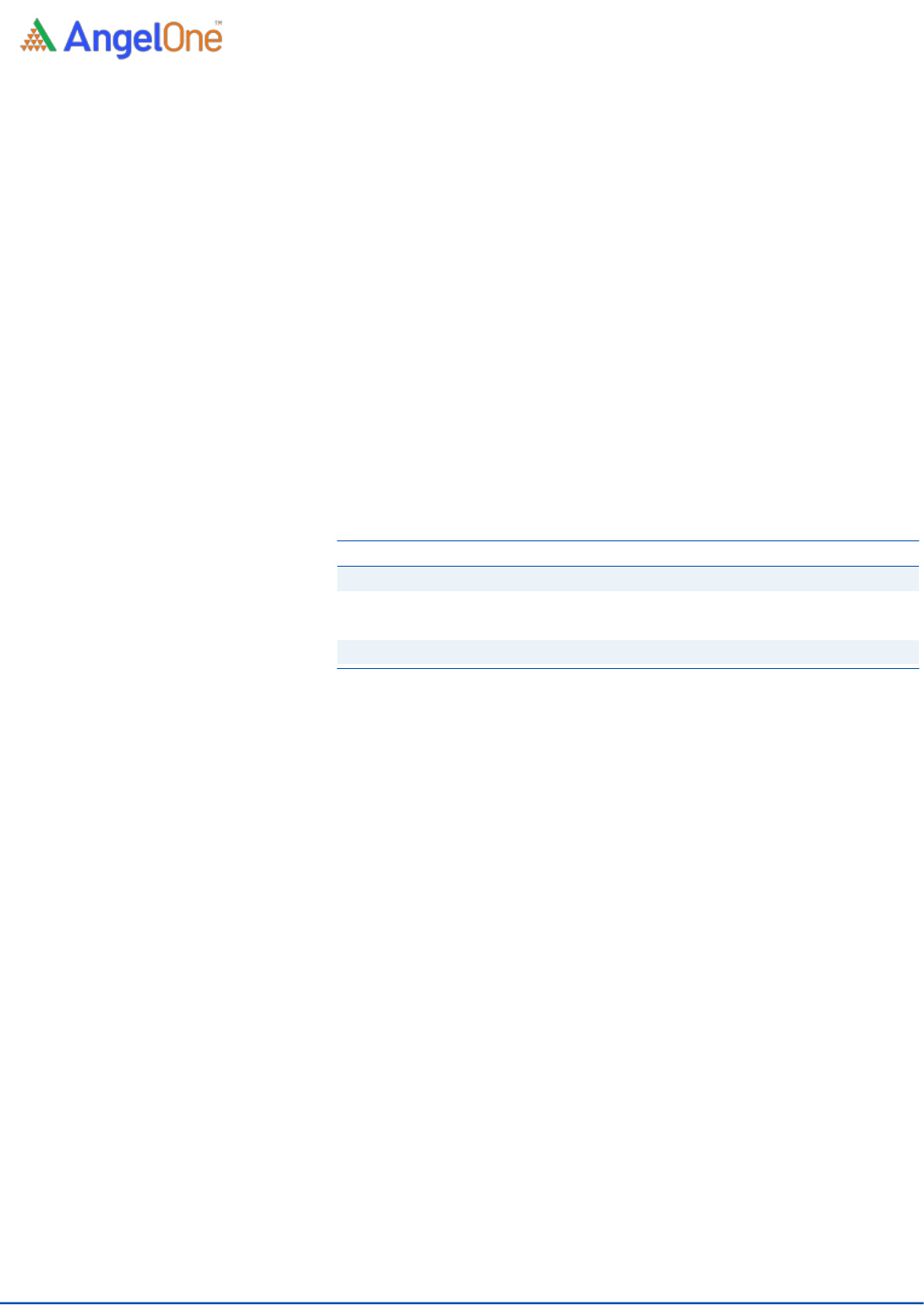

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

8,87,25,240

35.0%

8,87,25,240

33.1%

Public

16,45,78,690

65.0%

17,94,59,642

66.9%

Total

25,33,03,930

100.0%

26,81,84,882

100.0%

Source: Company, Angel Research

Objectives of the Offer

◼ Rs 500cr proceeds from the fresh issue would be utilized as follows:

o Up to ₹375cr utilized for investment in two of its Subsidiaries,

GHPPL and MHPL, in the form of debt or equity for

repayment/prepayment of borrowings of such Subsidiaries.

Global Health Ltd | IPO Note

November 2, 2022

3

Financial Summary

Income Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Net Sales

1,500

1,447

2,167

% chg

-4%

50%

Total Expenditure

1,314

1,255

1,716

Raw Material

325

349

543

Personnel

539

466

568

Other Expenses

450

440

605

EBITDA

187

191

451

% chg

3%

135%

(% of Net Sales)

12.4

13.2

20.8

Depreciation& Amortisation

115

123

130

EBIT

72

68

321

% chg

-5%

370%

(% of Net Sales)

4.8

4.7

14.8

Interest & other Charges

52

67

79

Other Income

44

31

39

(% of PBT)

68.7

96.8

14.0

PBT

64

32

281

% chg

-49%

764%

Tax

28

4

84

(% of PBT)

43.1

11.3

30.1

PAT

36

29

196

% chg

-21%

581%

Basic EPS (Rs)

1.4

1.1

7.7

Fully Diluted EPS (Rs)

1.4

1.1

7.3

Source: Company, Angel Research

Global Health Ltd | IPO Note

November 2, 2022

4

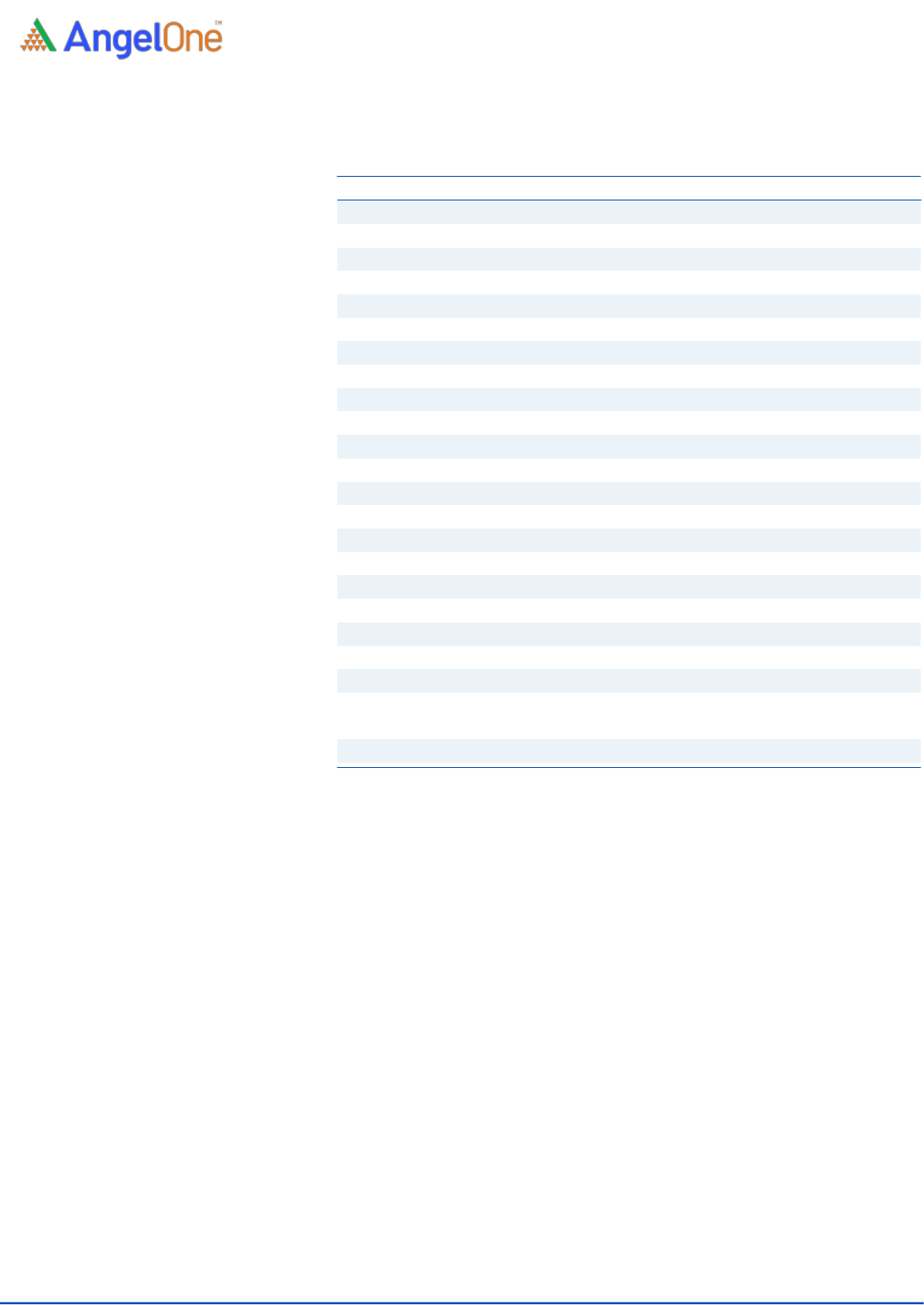

Balance Sheet (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

SOURCES OF FUNDS

Equity Share Capital

49

50

51

Reserves& Surplus

1,300

1,333

1,565

Shareholders’ Funds

1,350

1,382

1,616

Minority Interest

-

-

-

Total Loans

929

931

1,109

Other Liabilities

75

79

107

Total Liabilities

2,354

2,392

2,832

APPLICATION OF FUNDS

Net Block

1,703

1,616

1,776

Goodwill

-

-

-

Capital Work-in-Progress

382

464

439

Investments

-

0

0

Current Assets

479

502

812

Inventories

39

40

53

Sundry Debtors

149

134

180

Cash

250

289

512

Loans & Advances

-

-

-

Other Assets

41

39

66

Current liabilities

305

302

314

Net Current Assets

174

200

498

Deferred Tax Assets (net)

-

26

28

Deferred Tax Liabilities (net)

8

-

-

Other Assets

103

87

91

Total Assets

2,354

2,392

2,832

Source: Company, Angel Research

Global Health Ltd | IPO Note

November 2, 2022

5

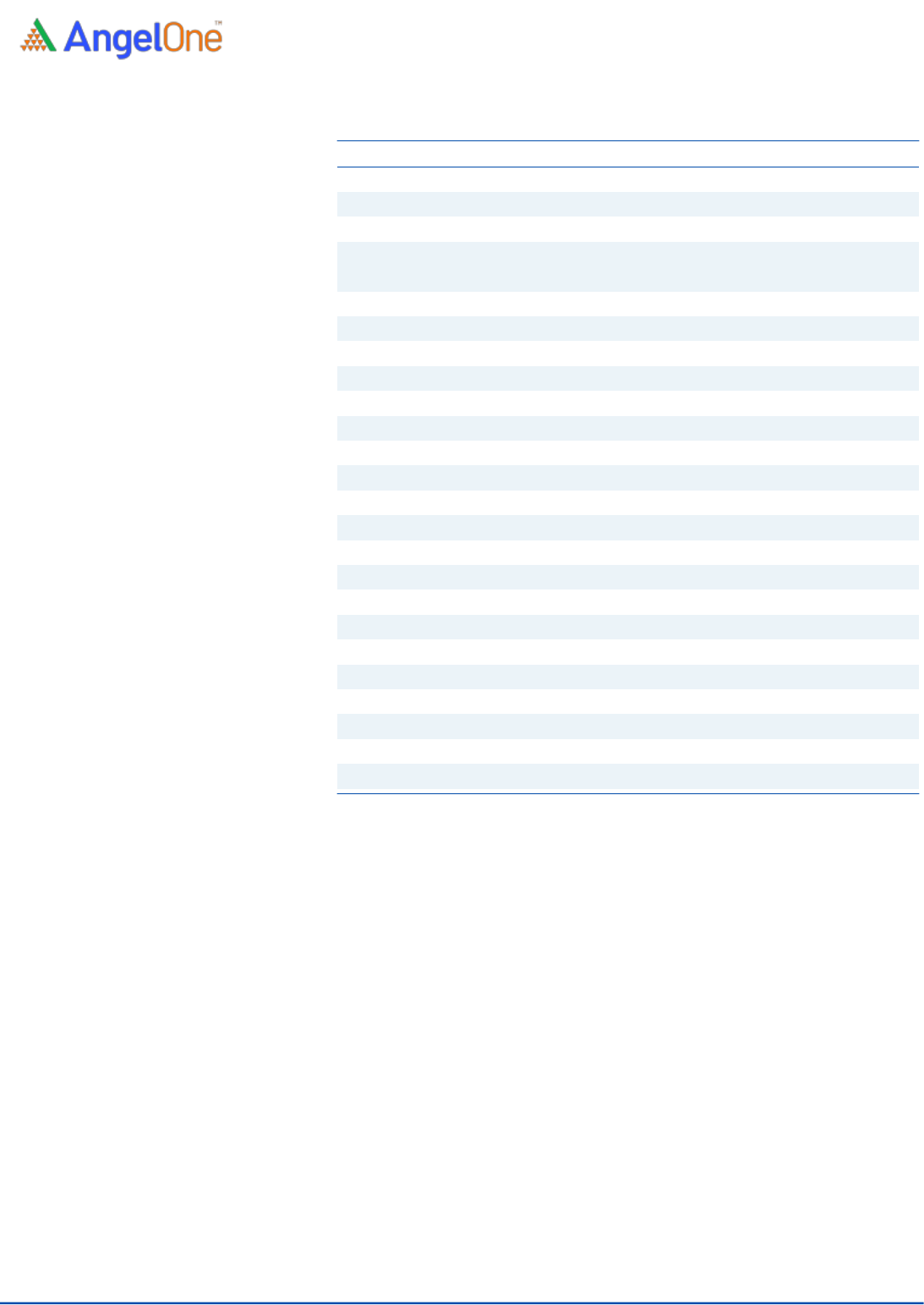

Cashflow Statement (Consolidated)

Y/E March (₹ cr)

FY’20

FY’21

FY’22

Profit before tax

64

32

281

Depreciation

115

123

130

Change in Working Capital

2

37

-67

Interest / Dividend (Net)

16

34

53

Direct taxes paid

(56)

-16

-98

Others

35

32

12

Cash Flow from Operations

175

242

311

(Inc.)/ Dec. in Fixed Assets

(188)

-142

-273

Movement in Bank Balances (Net)

81

(112)

-164

Interest Received

19

15

16

Cash Flow from Investing

(87)

(239)

-421

Proceeds from Issue of Share capital

0

0

38

Proceed / (Repayment) of long-term borrowings

94

(3)

215

Interest Paid on lease liabilities

(26)

(25)

-22

Payment of lease liabilities

(16)

(16)

-17

Interest / Dividend (Net)

(53)

(37)

-55

Cash Flow from Financing

(1)

(81)

160

Inc./(Dec.) in Cash

87

(78)

50

Opening Cash balances

60

148

69

Closing Cash balances

148

69

119

Source: Company, Angel Research

Key Ratios

Y/E March (₹ cr)

FY’20

FY'21

FY'22

Valuation Ratio (x)

P/E (on FDEPS)

248.4

313.2

46.0

P/CEPS

59.6

59.4

27.7

P/BV

6.7

6.5

5.6

EV/Sales

6.5

6.7

4.4

Per Share Data (Rs)

EPS (Basic)

1.4

1.1

7.7

Cash EPS

5.6

5.7

12.1

Book Value

50.3

51.6

60.3

Returns (%)

ROE

2.7

2.1

12.1

ROCE

3.1

2.9

11.8

Source: Company, Angel Research;

Global Health Ltd | IPO Note

November 2, 2022

6

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity

with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred

to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of

such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject

company. Research analyst has not served as an officer, director or employee of the subject company.